Future-Proof Your Banking

Architecture With BIAN

CC&C’s leadership position in BIAN certification training,

adoption, and implementation is helping banks fast-track their BIAN journey.

Navigate the complexities of legacy systems and architecture with CC&C Solutions – trusted partners to the world’s leading financial institutions.

How CC&C helps banks move to a modern,

composable, and agile architecture

A four-step process using BIAN to simplify and modernize your banking architecture

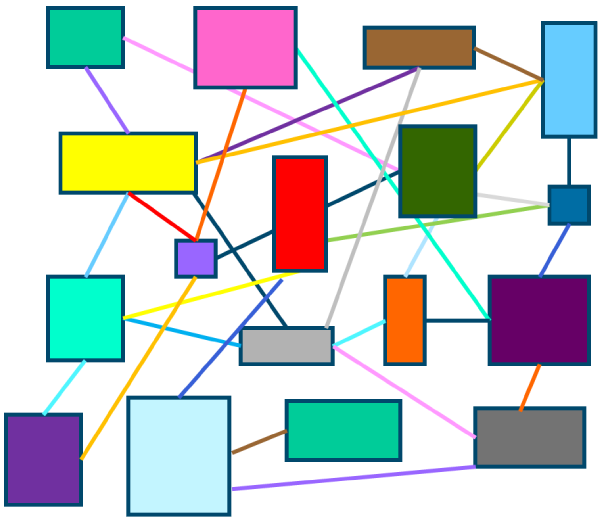

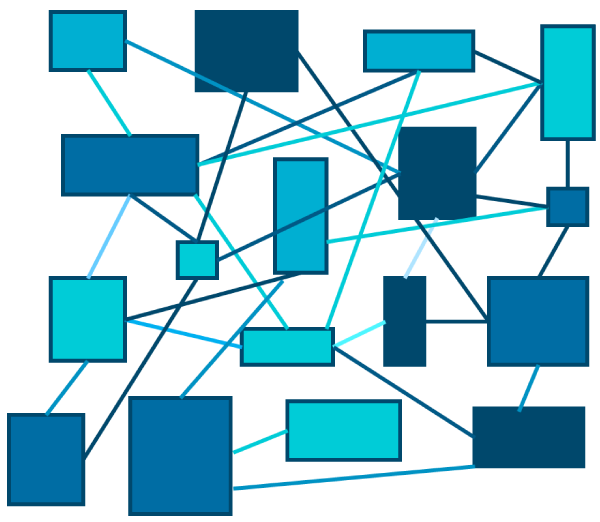

Step 1: Capture current state

- Fragmented enterprise landscape

- Duplicated capabilities

- Point-to-point API’s with no reuse

- Control gaps and regulatory risk

- Slow time to market

- High operational expense

Step 2: Map and classify

- Define BIAN-based Service Landscape and map applications

- Classify API’s and identify degree of BIAN alignment

- Identify duplication of capabilities

- Improve change impact analysis

Step 3: Align and wrap

- Group capabilities and align to business domains

- Leverage BIAN API’s to expose standard interfaces and abstract complexity

- Identify applications to invest vs retire

- Guide transformation planning

Step 4: Rationalize and reuse

- Rationalize capabilities to BIAN Service Domains

- Reusable BIAN-aligned API’s

- Alignment to other banks and vendors who have adopted BIAN

- Reduced cost of change and operational expense

CC&C Service Offerings

Business Capability Mapping

Enterprise Architecture Alignment to Standards

Proof of Value / Concept

Design Evaluation & Certification

Practitioner and Executive Training

BIAN-Aligned Design and Implementation

Architecture Governance

How Does BIAN Deliver Benefit

It is Canonical

The business function component designs BIAN specifies are standard for every use and user. The business role or purpose of each and every component can represent the systems needs of any type of bank, and can be consistently interpreted in any deployment

It is Stable Over Time

The BIAN model defines what each component does but does not attempt to define how it should do it. As a result, the BIAN blueprint and its component boundaries are extremely stable over time

It can be adopted incrementally

Systems built aligning to the model can be integrated alongside legacy systems and adopted incrementally. If well engineered, the internal workings of an application module can also evolve to include new practices and approaches as long as they keep to its original and discrete business role

It Enables Agility

By partitioning a bank’s functionality, data and interfaces into discrete self-contained service centers and breaking down monolithic design, BIAN enables banks to innovate and get to production much faster by quarantining change impacts

It Supports Composability

When solution providers and banks align with the model, banks can more easily mix and match system components developed by different providers and conversely solution providers can develop systems that can be more easily integrated in multiple banks.

It Helps Eliminate Complexity

Because the BIAN components are designed to support discrete and autonomous business functions, system development can better avoid creating the systems overlaps, duplication and redundancies that plague traditional solution designs

Our BIAN Training

BIAN Foundation Certification Training

Attain in-depth knowledge and understanding of the BIAN standard’s banking architecture with BIAN Foundation Certification training from our experts. Your trainer is an experienced BIAN architect who can address the “how” and “why” along with the “what”.

BIAN Data Architecture & Design Specialist Certification

Learn BIAN’s Business Object Model (BOM) in detail through an end-to-end use case. Your trainer is a BIAN-certified data specialist who can provide a practical working knowledge of how BIAN can be utilized to design a world-class data architecture.

Our Banking Clients

TESTIMONIALS

What our clients say

ANZ has discovered CC & C Solutions to be an invaluable partner in our BIAN journey. Their extensive knowledge and collaborative approach have contributed significantly to our success. The guidance, training, and support they provide are essential to our successful implementation.

ANZ BANK

My appreciation to CC&C for such an insightful training on BIAN

– Alfredo Palafox,

Deputy Chief Architect LAM,

HSBC

CC&C’s BIAN course gave me an excellent introduction into banking standards and certifications.

Abhishek Das

NTT Data

Join Our BIAN Mailing list

We dont’t sell your information to anynone

CC&C BIAN Webinar Series

Learnings and tips for rolling out BIAN in your organization

Interested in adopting BIAN in your enterprise, and keen to benefit from the learnings of those who have gone before you?

Transforming banking: Harnessing BIAN for a future-ready Architecture & Strategy

Join us to explore how you can leverage BIAN across multiple architectural domains

BIAN Implementation Journey

BIAN (Banking Industry Architecture Network) has been positioned as the essential foundation of a modern digital bank by major banks, banking solution providers, and industry observers.

If you are wondering how and where to start, we invite you to join us for this informative webinar conducted by BIAN practitioners to help embark on this exciting BIAN journey! A must for all current and aspiring banking technology professionals!

Bank on BIAN

Why BIAN certification matters

A must if you are a:

- Bank looking for readymade components for fast tracking solutions

- Banking professional interested in enhancing career prospects as a pioneer in this space

- Banking product vendor interested in expanding global market share

BIAN IN THE ERA OF OPEN BANKING

Learn how BIAN redefines the Open Banking Digital ecosystem

- BIAN Journey – A guide to adoption

- Using practical case study approach (Consumer Loan BIAN Alignment)